Update on IR35 changes

Published 24/02/2020

Published on 24/02/2020

An article in the Financial Times reports that Rishi Sunak, the chancellor of the exchequer has promised that tax officials will not be “heavy-handed” in enforcing tax law changes that are to affect tens of thousands of companies and 230,000 freelance contractors – at least not for the first year. Changes to the off-payroll working rules, known as IR35, are due to come into effect in April. To recap, the new law will require all companies — apart from those with fewer than 50 employees or less than £10.2m annual turnover — to assess the employment status of any person they hire, who works through a limited company. Companies and their recruitment agencies will be liable for unpaid tax if HM Revenue & Customs finds that a worker has been wrongly classified.

An ongoing Government review into the implementation of the changes will be published in advance of the budget on 11th March. Mr Sunal has stated that there will be some tweaks and improvements to make sure that the transition is as seamless as possible.

The Treasury said: “We recognise that this is a significant change for businesses, and as the chancellor has said, HMRC wants to take a supportive approach to help businesses to apply the rules correctly going forwards.” HMRC has set up dedicated teams providing education and support to all businesses, public bodies and charities affected by the change. This includes direct communications to about 40,000 medium-sized businesses. The Treasury said this was supported by workshops, online learning and round tables.

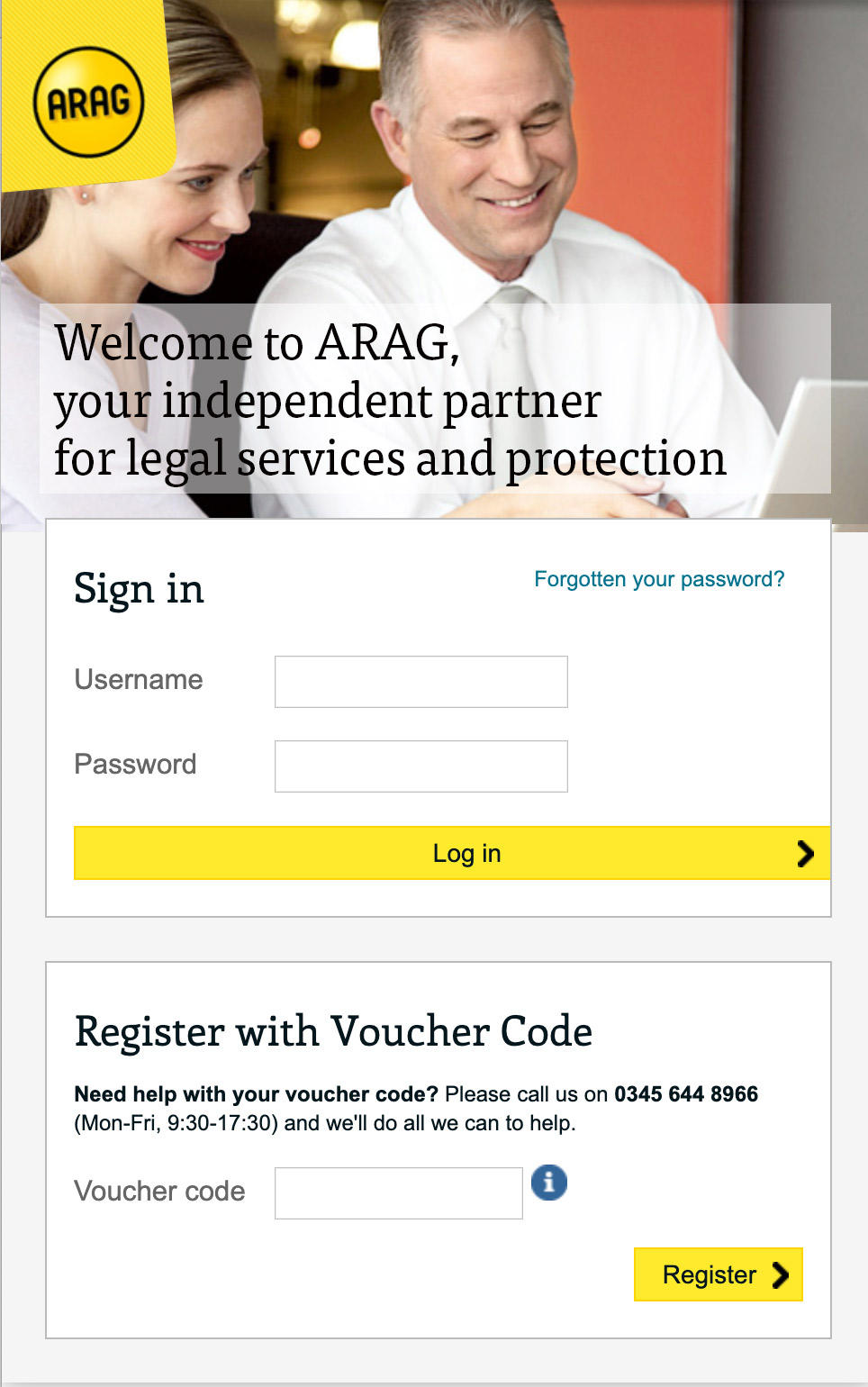

ARAG policyholders that engage the services of a consultant can build a legal document that can be used to draw up the terms of the consultancy. Business customers can register to access araglegal.co.uk using their website voucher code. The consultancy agreement document includes clauses covering remuneration, obligations and notice. It can be found in the Employment area of the website although it does not constitute a contract of employment. The agreement also deals with the issue of intellectual property. It is not suitable for those working in public sector services, the health and care industry or if they may have contact with children or vulnerable adults. The January 2020 Legal Bulletin outlines the above reform and summarises other upcoming changes to employment law and news from the Information Commissioner’s office. It’s published on www.araglegal.co.uk. Users of the araglegal website can opt-in to receive our monthly bulletin updates by email by updating their account profile preferences.

Disclaimer - all information in this article was correct at time of publishing.